EC311 Money, Banking, and Financial Markets

This course is an examination of the role of money, financial markets, and financial intermediation in the American economy, with a particular focus on commercial banks. It includes an in-depth look at the money supply process and the Federal Reserve System. Prerequisites: EC201 and EC202.

This course is designed to provide you with a thorough understanding of the importance of money, banking, and financial markets of a developed economy. Money, financial institutions, and financial markets have emerged as instruments of payments for the services of factors of production, such as labor and capital. The use of money facilitates business in a market by acting as a common medium of exchange. Of course, as that market expands and develops on a national and international level, the importance of money, banking, and other financial markets expands to accommodate innumerable exchanges. This course will allow you to examine not only the origins and nature of money, but also the institutions and markets that have evolved to enable the exchange of goods and services worldwide. It will provide you with the opportunity to examine the instruments and strategies assisting production, distribution, and consumption. Also, this course will help you develop an appreciation for important concepts in economics, from interest rates and central banking to stocks, bonds, and foreign exchange.

EC 311 Syllabus

Textbook

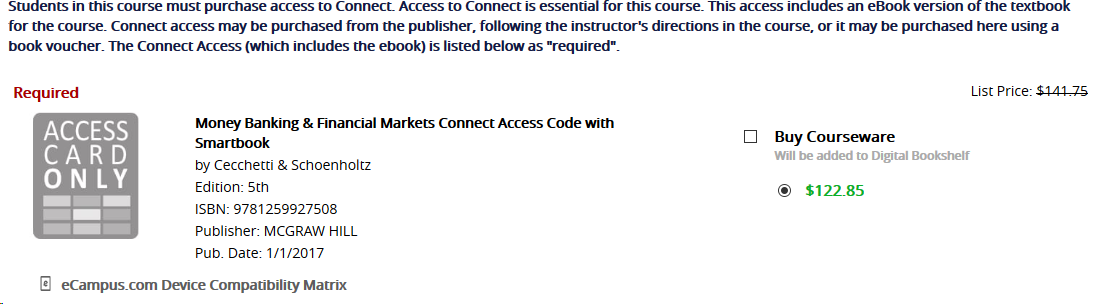

You have a couple of options for acquiring your textbook for the course:

Option 1 is to purchase the book from the Campus Bookstore:

Option 2 is to purchase it directly from the publisher's web site (can save you a few dollars!):

http://bit.ly/2QHdUW5

Follow the instructions here to register for McGraw-Hill Connect with LearnSmart. This is where you will complete your assignments and exams for this course.

Registration Instructions for McGraw-Hill Connect with LearnSmart